how much are payroll taxes in colorado

Taxes Paid Filed - 100 Guarantee. One of the new.

Colorado State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Do you make more than 400000 per year.

. In total Social Security is 124. The state income tax rate in Colorado is a flat rate of 455. Ad Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You.

A state standard deduction exists. This 153 federal tax is made up of two parts. Payroll tax is 153 of an employees gross taxable wages.

Colorado State Directory of New Hires. The new employer UI rate in Colorado for non-construction trades is 170. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Get Started With ADP Payroll. Explore our full range of payroll and HR services products integrations and apps for. Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

How to File Online. Whose tax payments may increase. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Process Payroll Faster Easier With ADP Payroll. The major economy contributors are agriculture mining manufacturing and tourism. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Colorado imposes a 290 sales tax with localities charging 475 for 765 percent. Filing Frequency Due Dates. Ad Process Payroll Faster Easier With ADP Payroll.

The employer withholds 62 from employee paychecks and also pays the employer portion of. An organization will be deemed to be doing business in Colorado if it is engaged in any. 124 to cover Social Security and 29 to.

Each tax type has specific requirements regarding how you are able to pay. If youve already filed your Colorado state income tax return youre all set. The Centennial State has a flat income tax rate of 450 and one of the lowest statewide sales.

Get Started With ADP Payroll. The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for. Colorado New Hire Reporting.

Calculating your Colorado state income tax is similar to the steps we listed on our Federal. Colorado income tax rate.

Payroll Tax Calculator For Employers Gusto

Colorado Democrats Are Planning The State S Biggest Tax Reform In Years Colorado Public Radio

Colorado Payroll Tools Tax Rates And Resources Paycheckcity

A Complete Guide To Payroll Payroll Taxes For Colorado

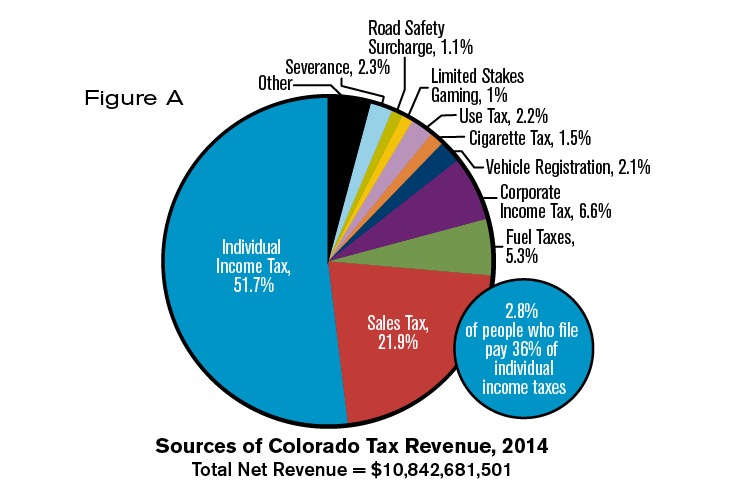

Tax Policy And The Colorado Economy Common Sense Institute

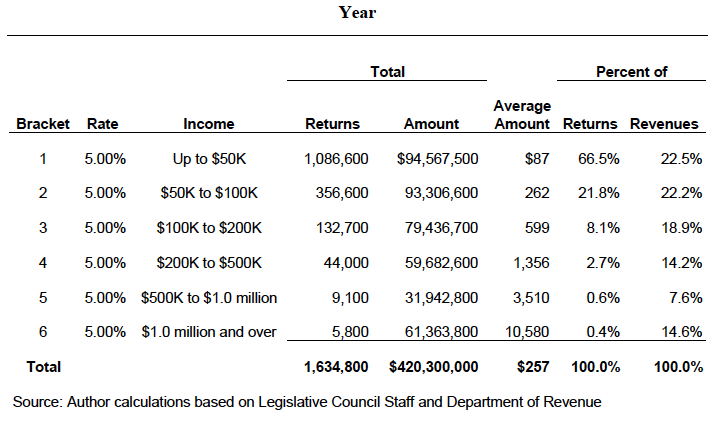

Who Pays Colorado Taxes Independence Institute

State W 4 Form Detailed Withholding Forms By State Chart

Llc Tax Calculator Definitive Small Business Tax Estimator

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

:max_bytes(150000):strip_icc()/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-b2584d2f80b043d0814fca81c1b1fecf.jpg)

How To Budget For Taxes As A Freelancer

A Complete Guide To Payroll Payroll Taxes For Colorado

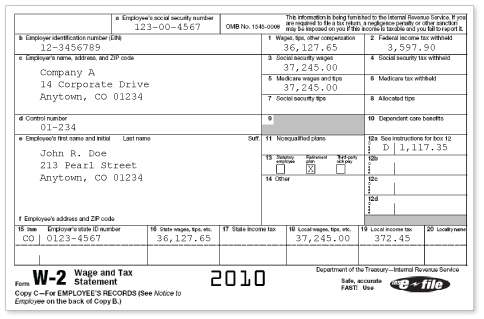

Math You 5 4 Social Security Payroll Taxes Page 240

5 Big Tax Bills That Passed In Colorado That Will Affect Your Wallet

Colorado Retirement Tax Friendliness Smartasset

Payroll Taxes 101 What Employers Need To Know Workest